Infinite Return Trade Idea: SPY Iron Condor (1-15-25) Rolled Out To A Later Date

This is one of my best strategies that will eventually pay me forever

The SPDR S&P 500 ETF SPY 0.00%↑ is increasing today after the CPI release.

It’s holding at resistance. Although the daily momentum is increasing, the weekly and monthly are still decreasing. This likely means rallies and declines will fail until there’s alignment. This is a good environment for iron condors.

Find out which strikes and expiration dates I choose to benefit in this environment. I also have room to adjust while making money if SPY goes sideways, up and down to a certain point.

Lastly, learn how I plan to turn this into an infinite return trade.

Part one of this trade returned $53 (a 42.4% return in 15 days. The total credit received is now $111 for my SPY infinite return strategy. Because the collateral required is $200. I only need to earn $90 more dollars using this strategy to take all my risk off the table and have infinite returns.

If you didn’t make the last trade, don’t worry. Today is the best time to start this strategy if you missed the first one. I will continue this strategy all year and beyond.

This is not financial advice. Please do your own research and do what’s best for you.

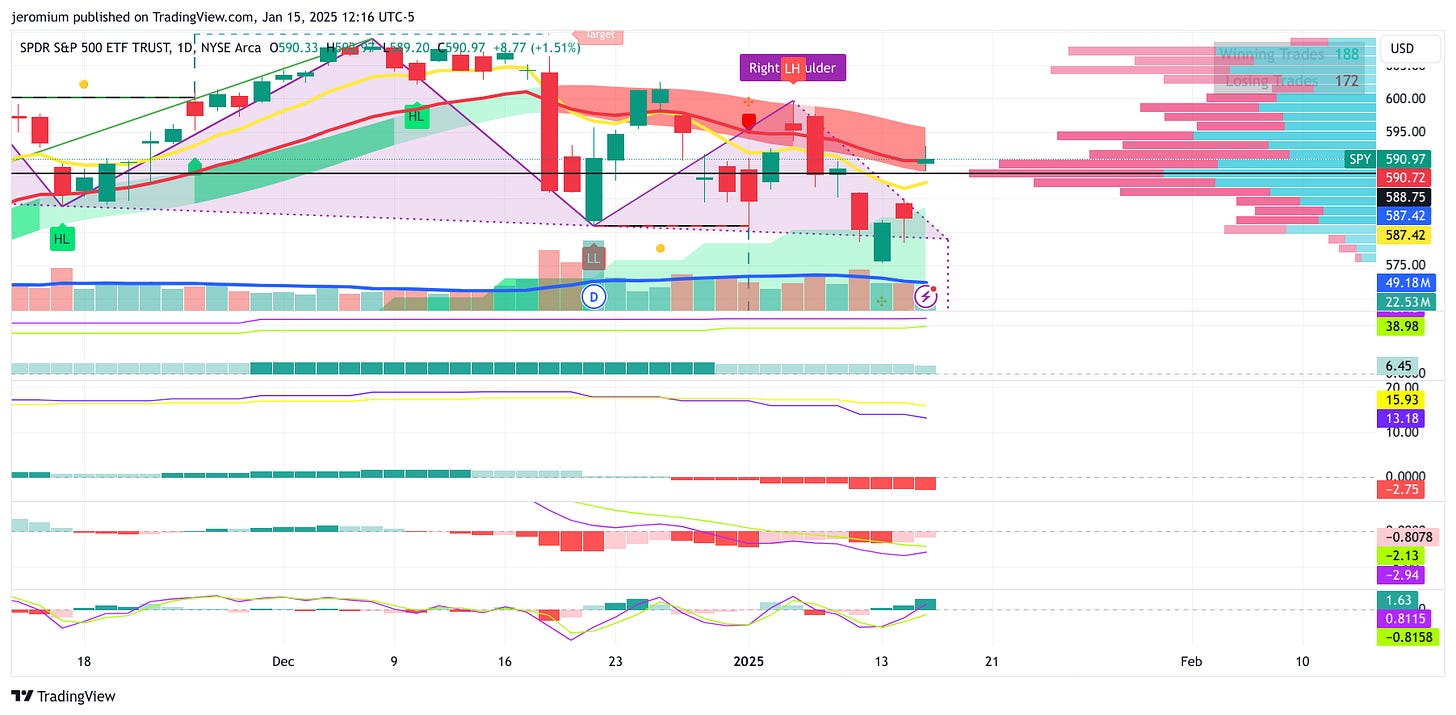

SPY Daily Chart

SPY is in a range between support and resistance. The momentum is still negative on the weekly and monthly, but it’s increasing on the daily chart. This means it’s likely to trade in a range for a few weeks.

Below, the MACD on the chart from top to down is the monthly, weekly, daily, and hourly.

Please consider a premium membership before prices increase on January 1, 2025. It will allow me to devote more time and resources to finding opportunities and teaching highly profitable strategies.

Keep reading with a 7-day free trial

Subscribe to Ageless Investing to keep reading this post and get 7 days of free access to the full post archives.