The Second Great Wave: A Generational Opportunity in the Offshore Drilling Super-Cycle #3

How a powerful 'Anchoring Bias' created a generational mispricing, leaving financial fortresses trading for the price of their ashes.

Hi, and welcome to #3 of the weekly The Diligent Hand deep dives.

This week’s report is based on my 100+ page analysis of this company and industry. I tested the strongest bullish and bearish theses and found the bearish thesis fragile and the bullish thesis antifragile.

This is a premium analysis of the three best companies in the industry, ranked from best to worst.

The company has a perfect storm aligning with peak market pessimism and management optimism.

My original format had one analyzed company a week using the original The Diligent hand guides. But I’ve dramatically updated these guides, making the old ones still useful, but no match for the latest versions.

Analyzing the best companies in industries with strong tailwinds is far more efficient than analyzing one company at a time, as with the original format. Due to this, I will share analysis for at least 4 companies a month instead of 1 per week.

The downside, no more weekly analysis. The upside, a deeper dive into the industry with more insights and company comparisons. This will likely mean you get more than one analyzed company a week, along with institutional-level industry deep dives.

The best part is, the more industry deep dives we do, the more connections and second-order effects we find, giving us a significant edge. I’ll share my web of industry deep dives that will help us stay ahead of trends and know where to find hidden gems and avoid landmines.

Also, as my watch list of top-ranked analyzed companies grows, the more I will find and share opportunities for grade A entries for short options trading and long-term investing.

See our example analysis here that still offers a great long-term entry:

The offshore drilling industry, for most investors, is a graveyard haunted by the ghosts of the 2014-2020 bust. It’s a sector famous for destroying billions in capital, a textbook "capital incinerator" that has, with remarkable consistency, built too many ships at the top of the cycle and been forced into bankruptcy at the bottom.

Acknowledging this painful history is the only credible starting point for any analysis. Why would any diligent, fundamentals-based investor dare to venture here?

In this deep dive, we’ll argue that this well-deserved stigma is the source of a generational mispricing. We will demonstrate that a rare confluence of structural, physical, and psychological factors has created a durable super-cycle.

And within this cycle, we have identified an "Invincible Fortress," a company so transformed and so deeply undervalued that it represents the rarest and most compelling investment setup in our entire analytical universe: a "Royal Flush."

This is a classic conflict between the market's emotional, narrative-driven "System 1" thinking and the data-driven reality of our "System 2" analysis. Our thesis is built not on a volatile forecast of oil prices, but on the non-negotiable physical reality of an aging global rig fleet, the near-impossibility of building new ones, and the relentless mathematics of deepwater depletion.

Part I: The Anatomy of a Flawed Narrative (The Market's Blind Spot)

Chapter 1: The "Peak Oil Demand" Fallacy vs. The Reality of Depletion

The market's primary analytical error is a fundamental misunderstanding of the relationship between oil demand and the demand for drilling services.

The prevailing "System 1" narrative assumes that a plateau or eventual decline in global oil demand automatically translates to the obsolescence of the offshore drilling industry. This is a dangerously flawed oversimplification that ignores the most powerful force in oil production: geological depletion.

Our deep research into the global oil market confirms that deepwater oil fields, which hold the majority of the world's remaining large-scale reserves, exhibit the highest natural decline rates in the industry, often between 10% and 18% annually [Offshore Magazine].

This is a non-negotiable law of physics. To put this into perspective, for every 10 million barrels per day produced from a deepwater basin, between 1.0 and 1.8 million barrels of that capacity vanishes each year and must be replaced just to keep production flat. The world is on a treadmill that requires constant forward motion just to stay in the same place.

A significant baseline of drilling activity is not speculative or dependent on high oil prices to incentivize growth; it’s non-discretionary maintenance. Major oil producers like ExxonMobil and Chevron must continuously drill new wells to offset this relentless decline and maintain the production levels that underpin their multi-billion-dollar cash flows.

The market narrative focuses on the first derivative (the change in oil demand) while ignoring the far more powerful zeroeth derivative (the immense existing demand that must be constantly replenished). The demand for high-specification drilling rigs isn’t a bet on "peak demand" being far off; it’s a bet that depletion is real and happening now.

Chapter 2: The "ESG Echo Chamber" & The Offshore "CapEx Ice Age"

The second layer of the market's flawed narrative is its misinterpretation of ESG pressure as a simple headwind. For the offshore drilling sector, years of ESG-driven capital starvation have paradoxically forged the single greatest competitive moat in its history by systematically destroying the future supply of its key assets. This is the "Accidental Fortress" thesis in its purest form.

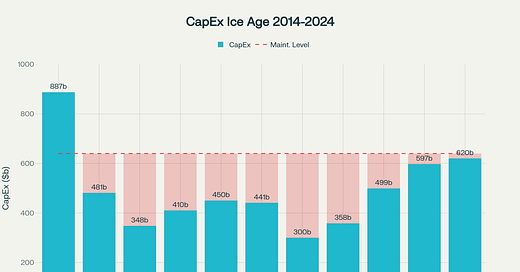

The data on this front is not just compelling; it’s absolute. Our research confirms that global upstream capital expenditures collapsed from approximately $900 billion in 2014 to a trough of around 300 billion in 2020 and have only partially recovered to the 300 billion in 2020 and have only partially recovered to the 500 billion level today [Deloitte].

This isn’t a "CapEx Winter"; it’s a"CapEx Ice Age."The brutal 2014-2020 downturn, compounded by intense ESG pressure on banks and investors to shun the sector, completely shut down the speculative newbuild cycle that defined previous eras. Our research confirms there have been zero newbuild orders placed for floating rigs since 2018[Rystad].

Furthermore, the physical capacity to build these complex assets has been structurally impaired. Our research shows that many of the specialized shipyards capable of constructing high-specification drillships have either gone bankrupt or have repurposed their docks for more reliable LNG carrier and containership construction.

The few remaining capable yards have extended their delivery timelines to 3-4+ years and are demanding newbuild prices exceeding $1 billion per rig, a level that requires day rates far above even today's high levels to be economical.

This creates an insurmountable barrier to entry. As confirmed by the latest "The Old Economy" market report, the supply of modern, high-specification rigs is now, for all practical purposes, fixed for at least the next 3-5 years [July Offshore Market Report

].The market, suffering from a powerful Anchoring Bias to the memory of the oversupplied 2014 market, fails to appreciate that the rules of the game have fundamentally changed.

The very ESG movement that was meant to be the industry's undoing has, in effect, guaranteed a multi-year, structurally undersupplied market for the incumbent owners of modern drilling assets.

Part II: The "Irrefutable Supply" Crisis - Why This Cycle is Different

Having established in Part I that the market's narratives on demand (the "Peak Oil" fallacy) and future supply (the "ESG Echo Chamber") are deeply flawed, we now turn to the physical reality of the existing global rig fleet.

It’s here that the contrarian thesis moves from a compelling theory to a near-mathematical certainty. The current super-cycle isn’t driven by a temporary demand spike, but by a permanent, structural, and irreversible degradation of the global supply of drilling assets. This isn’t a cyclical downturn that can be easily fixed; it’s a systemic crisis of attrition.

Chapter 3: The "Scrap Chasm": An Aging Fleet Meets the Grinder

The most powerful, non-negotiable force shaping this industry for the next decade is the age of its assets. A rig, like any piece of complex industrial machinery, has a finite lifespan. The global offshore fleet is now facing a "retirement wall" of unprecedented scale.

Our research paints a stark picture of this impending "Scrap Chasm." The workhorse segments of the industry are ancient by industrial standards. A staggering 65% of the global semisubmersible fleet is now over 20 years old, with a significant portion rapidly approaching the 25-year mark where major, prohibitively expensive five-year surveys are required [Westwood].

For jack-up rigs, the situation is even more dire, with 30% of the fleet over 35 years old.

This isn’t a theoretical problem. The industry standard, as stipulated by the major oil companies who charter these rigs, is for assets to be no more than 15 years old. Rigs exceeding this age face commercial extinction, relegated to lower-tier work at lower day rates, if they can find work at all.

The historical data shows that while high day rates can tempt owners to keep older rigs working, the laws of physics and metallurgy are absolute. The 2020 downturn saw an acceleration of scrapping, with drillships as young as nine years old being retired.

The current period of high utilization is merely delaying the inevitable. The massive wave of rigs built in the late 1990s and early 2000s is now reaching the end of its operational life.

This creates a non-discretionary, structural decline in the number of available rigs. When we juxtapose this "retirement wall" with the "CapEx Ice Age" detailed in Part I, where zero new floating rigs have been ordered since 2018, a chasm opens up.

We call this the "Scrap Chasm": the massive, structural, and widening deficit between the number of rigs that are being mandatorily retired and the near-zero number of rigs being built to replace them.

The market tightness is already here. As the July 2025 "The Old Economy" market report confirms, the utilization for the global floater fleet is now "pushing 94%." [July Offshore Market Report].

This is a critical data point. It’s quantitative proof that there is no slack left in the system. The "Scrap Chasm" isn’t a future forecast; it’s a present reality that is tightening the market with every passing month.

Chapter 4: The "High-Spec" Bifurcation: Not All Rigs Are Created Equal

The second critical component of the supply crisis is a profound bifurcation in the quality of the available assets. The market for offshore rigs is not a single, homogenous entity; it has split into two distinct, non-interchangeable tiers.

Keep reading with a 7-day free trial

Subscribe to Ageless Investing to keep reading this post and get 7 days of free access to the full post archives.